We have talked with many of you about Napatree Capital’s flagship Focused Value strategy. Focused Value currently owns 47 high quality companies that in our analysis, have been temporarily underestimated and mispriced by the market. The following is a brief analysis behind a recent addition to the Focused Value portfolio: Molson Coors (symbol: TAP).

Our investment team continually reviews data on stocks that fit certain criteria, through a comprehensive analytic process. Our quantitative approach identified TAP in mid-January of this year.

Our process prompted more in-depth analysis and here is what we uncovered:

- In late 2019, under their new CEO, Molson Coors launched an aggressive revitalization plan to both grow its core brands and expand their beverage offering beyond the beer aisle into the growing seltzer and energy drink markets.

- Simultaneously, they planned to invest in their manufacturing capabilities and improve process efficiency.

- In early 2020, the global COVID pandemic hit and consumer purchases came to a standstill. Molson Coors smartly suspended their dividend and paid down debt, but also marched forward with their revitalization strategy. As expected, the stock price was punished in the global pandemic-driven sell off.

We came to two critical conclusions:

- Molson Coors’ lower 2020 financial performance was largely due to the on-premises lock down in Europe which we felt would eventually recover and likely thrive, and

- Their aggressive revitalization strategy was showing signs of early success.

The stock price had yet to recognize these developments. In their February 2021 earnings call, management signaled that the dividend would likely be reinstated sometime in 2021 – while some analysts hoped they would reinstate it earlier. The stock sold off another 10% and that gave us an opportunity to own a great company at an even more compelling valuation.

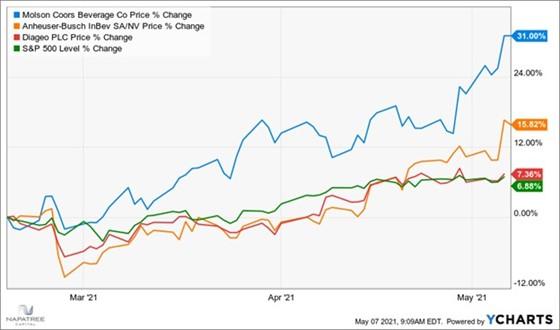

We started accumulating the stock in mid-February in the $44-45 range. In their April earnings call, Molson Coors beat expectations and posted a profit. Below is an illustration of the performance since purchase, versus its two biggest competitors and the broader market (S&P 500).

With the global recovery in process, a dividend reinstatement on the horizon, and a suite of compelling consumer beverages beyond its core beer brands, we are happy to be a long-term owner of Molson Coors.