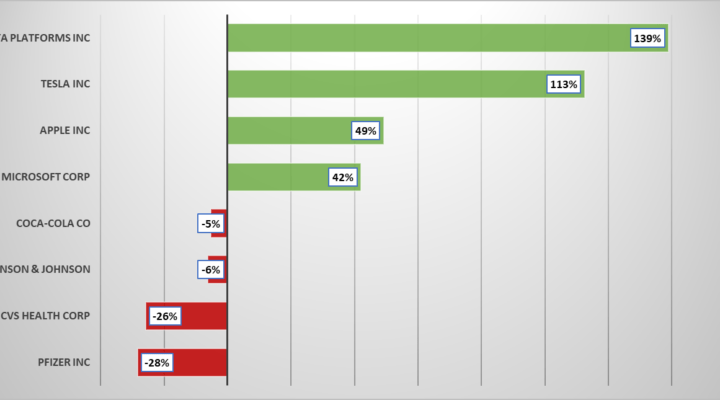

The previous Napatree quarterly commentary, “Divergent Paths,” illustrated that the broad stock market, most quoted as the S&P 500, generated a nearly 17% return through June 30. But under the covers, many stocks in that index performed poorly. Returns were dominated by the largest companies in the index. From the conclusion in that commentary: Broad […]

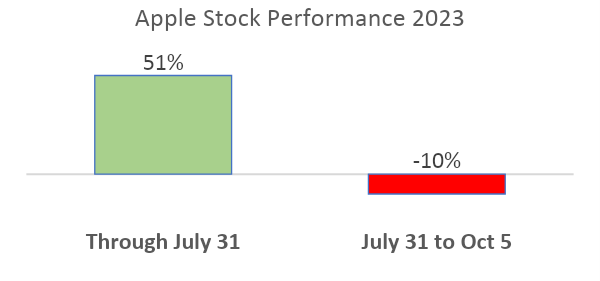

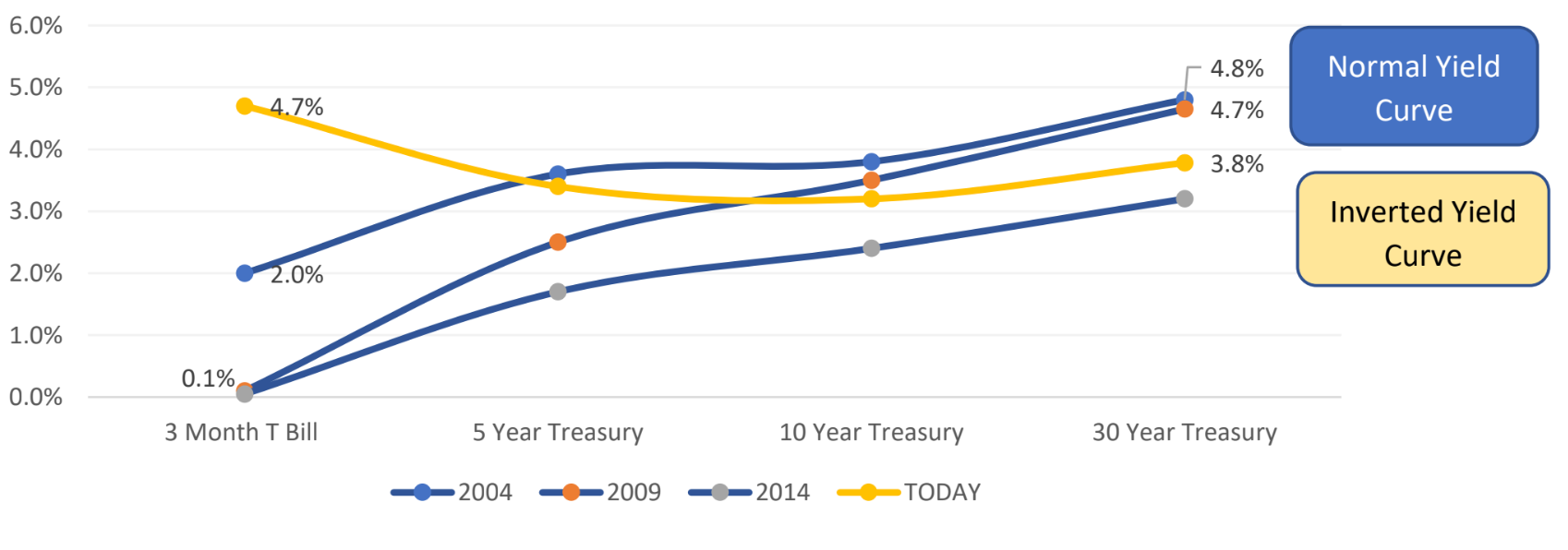

Read MoreThe start of the fourth quarter has been rough for financial markets, a follow-through from when stocks hit a 12-month high in July. The factors contributing to the sell-off: All is not dire, however. Financial markets look ahead and so do we . . . below is our stance on the issues outlined above:

Read MoreIs Washington, D.C. broken? The global rating agency, Fitch, certainly believes so. On Aug. 1, the company downgraded the credit of the United States one notch, from AAA to AA+. It is only the second time in history that our nation’s credit has been downgraded, the first in August 2011 by S&P. In its explanation, […]

Read MoreOne of the more nuanced dynamics in the stock market this year is the wide range of performance among various indices. The technology-led Nasdaq has been the clear winner for the first six months of 2023, up 32%, far outpacing both the Dow Jones Industrial Average and the much broader S&P 500, which are up […]

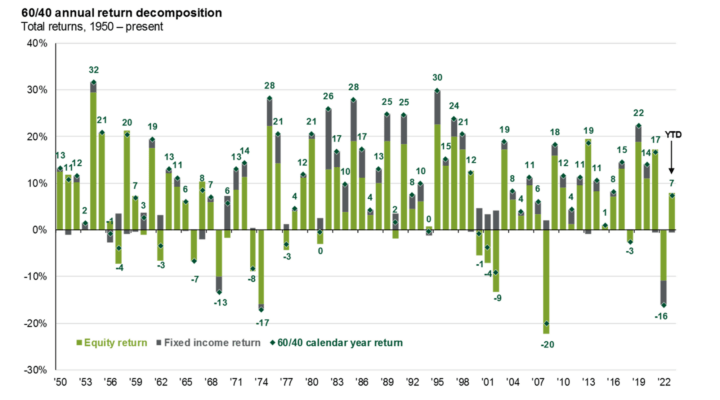

Read MoreThe first quarter of 2023 ended with most major stock market averages in positive territory. The tech-heavy NASDAQ led the way with a whopping 16.8% return, which means growth investing has roared back after a miserable 2022 in which the NASDAQ posted a -33% return. The disparity between performance in market averages for the first […]

Read MoreAnalysis by Jeff Liguori for BusinessWest.com Silicon Valley Bank (SVB), a California-based lender, was taken over by the FDIC due to fears of insolvency. The process was one of the swiftest in history. Silicon Valley Bank was a niche banking franchise founded in 1983 to fill a growing need in the financial-services marketplace. The primary customers […]

Read More