How challenging was 2022 for investors in the US? Stocks and bonds have not produced negative returns of this magnitude, in the same calendar year, for more than fifty years. The closest parallel to the previous twelve months is the late 1960s/early 1970s, because the volatility is almost entirely due to inflation. That was a […]

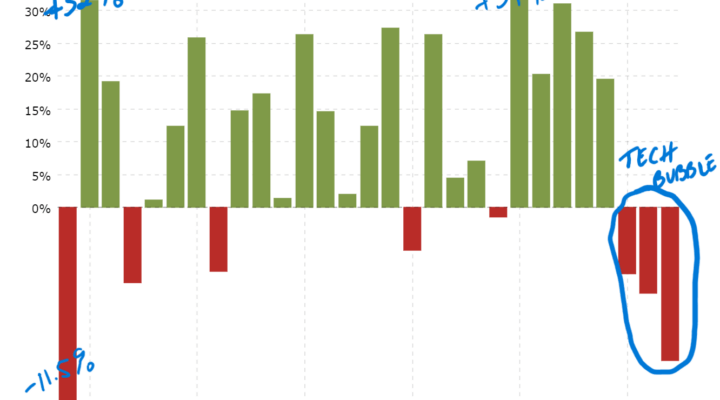

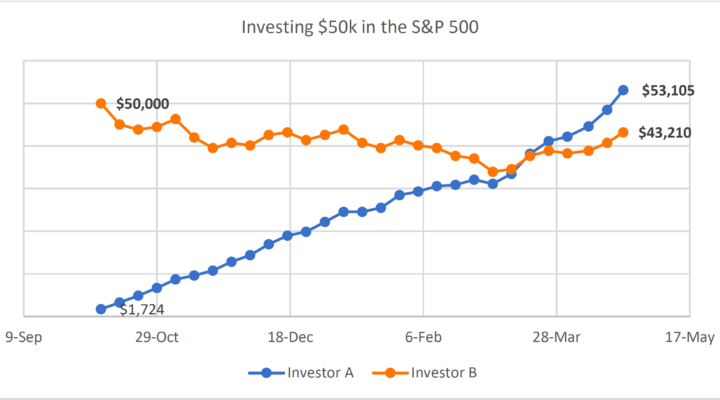

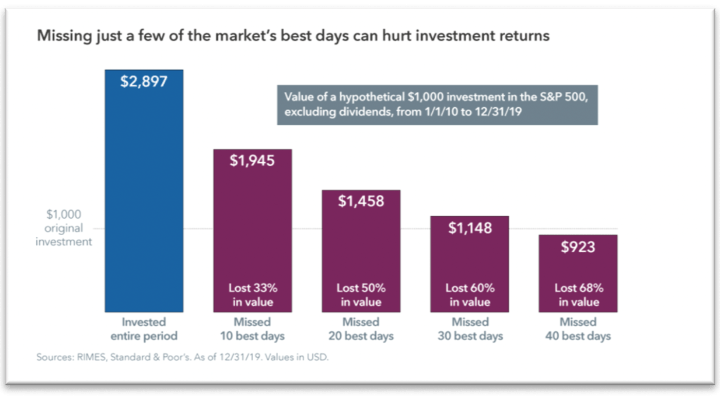

Read MoreIt is the ideal term for the current market environment. It seems as though each time markets attempt an advance, the bottom falls out. Maybe it really is difficult to time these things… Since our last note in the third week of June, where we highlighted extreme bearishness among investors, stocks rallied almost 18% into […]

Read MoreWhen markets slide, investors’ knee jerk reaction is to draw parallels to difficult markets in the past. The most recognizable episode in recent history is the Great Financial Crisis (GFC) of 2008-09. The S&P 500 peaked in October 2007, followed by a crushing sell off that bottomed out in March ’09 — but not before […]

Read MoreYou’ve heard we’re in a bear market. We don’t particularly care for that term because it only helps stoke investors’ fears. Too much ink is wasted on deciding when a bottom occurs during “bear” markets. It is a fool’s errand. The current investment climate is concerning. The weakness we’re seeing in stock and bond prices […]

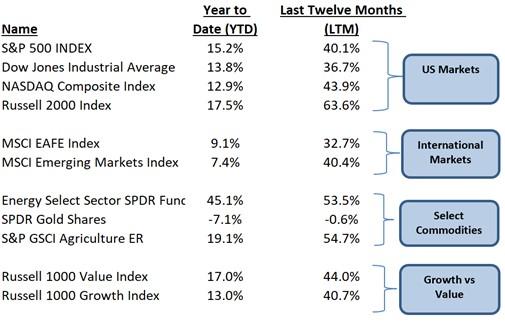

Read MoreBelow is the performance of major indices through the end of September. A few themes to highlight: Russell 2000, which is an index of small, public companies (small caps), has appreciated nearly 50% in the past year. We believe the strength of this segment of the market is characteristic of investors having a healthy risk […]

Read MoreLet’s start with a recap of 2021 thus far. It is hard to imagine that a little more than a year ago investors were emerging from sheer panic selling as the world struggled with the pandemic. But such is the cycle of investing; typically, that panic sets the stage for strong gains, and here we […]

Read More