In our last quarterly commentary, “A Nervous Bull”, we discussed how a little bit of investor worry actually fuels abull market. The volatility of the past week has not changed our opinion. In fact, we believe the type of pullback weare seeing in stocks is a welcome event and should propel the market higher, potentially […]

Read MoreIn our last quarterly commentary, “A Nervous Bull”, we discussed how a little bit of investor worry actually fuels a bull market. The volatility of the past week has not changed our opinion. In fact, we believe the type of pullback we are seeing in stocks is a welcome event and should propel the market […]

Read MoreIn 1984 there was a popular commercial for Dunkin’ Donuts, featuring an exhausted baker who proclaimed daily, “time to make the donuts”. For nostalgia’s sake it can be viewed here on YouTube. That phrase, because of the popularity of that ad, became synonymous with “time to go to work” in the mid-to-late eighties. This week […]

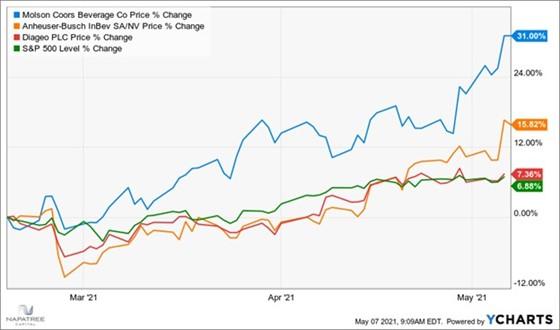

Read MoreWe have talked with many of you about Napatree Capital’s flagship Focused Value strategy. Focused Value currently owns 47 high quality companies that in our analysis, have been temporarily underestimated and mispriced by the market. The following is a brief analysis behind a recent addition to the Focused Value portfolio: Molson Coors (symbol: TAP). Our investment team continually […]

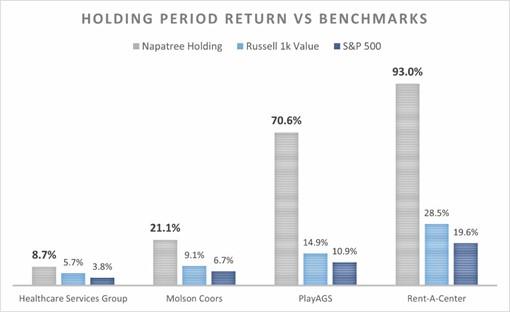

Read MoreIn this week’s brief, we thought it might be interesting to share our most recent investments in our flagship Focused Value equity strategy. These four investments, shown below in descending chronological order, are Healthcare Services Group (HCSG), Molson Coors (TAP), PlayAGS (AGS), and Rent-A-Center (RCII). As illustrated below, the longer our holding period, the greater the […]

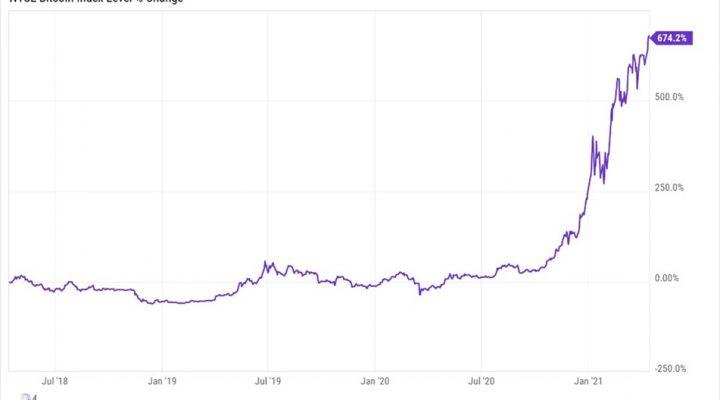

Read MoreThe news of the week in the financial world was without a doubt, the debut of the Coinbase Initial Public Offering under the ticker symbol COIN. Coinbase is an exchange for Cryptocurrencies like Bitcoin, Ethereum and other ‘Alt Coins’. The service enables a user to go on their website or download their app, easily connect […]

Read More