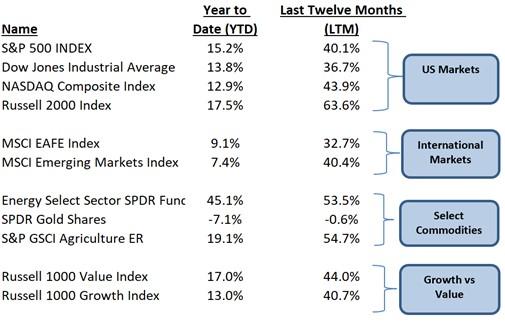

Let’s start with a recap of 2021 thus far. It is hard to imagine that a little more than a year ago investors were emerging from sheer panic selling as the world struggled with the pandemic. But such is the cycle of investing; typically, that panic sets the stage for strong gains, and here we are.

With six months in the rear-view mirror, we will review two trends that will get more attention as 2021 marches on.

Inflation: Why are My Groceries so Expensive?

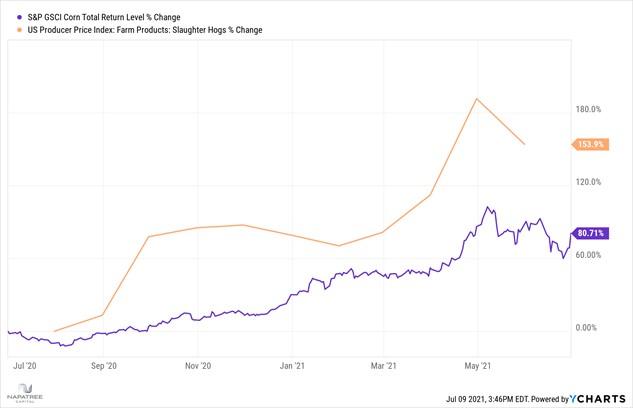

The Wall Street Journal published a video relating the inflationary trend to what is on your breakfast table (seen here). Whether or not you have a morning bowl of corn flakes, the price of corn widely affects prices of many consumer goods. It is the main feed source for the animals from which we get meat and eggs. Ethanol, which is used to produce gasoline, is also made from corn.

As seen in the chart below, the price of corn is up over 80% from a year ago. Farmers have had to increase the price of the beef, chicken, pork, and eggs that they sell as a result. Similarly, gas prices have gone up because the cost to produce gas (at least the portion that is ethanol-based) has increased. Such intermediaries – farmers, oil refiners – need to maintain a profit margin so the higher cost is passed to you, the consumer. Add in higher demand with a stronger economy, and inflationary pressure is unlikely to subside anytime soon.

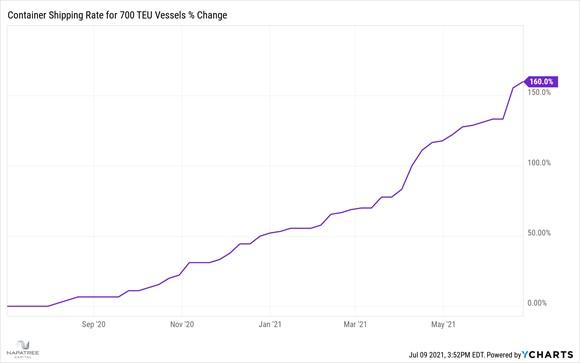

Another data point that illustrates why inflation has spiked recently, is the cost to move goods around the world. All freight rates – trucking, rail, container ship – have risen in the past year. Interestingly, the labor shortage and complications with the supply chain have put an added strain on shipping. Those companies need to maintain profits as well; ultimately higher shipping costs drive the price of everyday goods higher too.

Fear not however, we believe that some of the price hikes will be alleviated as chokes in the global supply chain loosen. Furthermore, Janet Yellen – former Fed Chair, and current Treasury Secretary – during an interview with Bloomberg News, argues that modest inflation will bring higher interest rates which is not necessarily all bad.

“We’ve been fighting inflation that’s too low and interest rates that are too low now for a decade,” she said. She added that if the administration’s spending proposals help at all to “alleviate things then that’s not a bad thing — that’s a good thing.”

Growth vs Value: A Continued Conversation

For the second half of the year, we expect that skilled investors will dig in a bit deeper to those companies that exhibit the classic traits of value investing. Growth stocks, like Tesla, Peloton, and Zoom Video, have their place in portfolios. But valuations for the “growthiest” of companies are high, especially relative to history. It is why you hear “the market is expensive”. The sectors which generally get the most attention by the financial media – namely technology – are trading at lofty multiples of predicted future earnings. Meanwhile, shares of many reputable companies with predictable cash flow streams are trading at a discount relative to the broader market, and are inexpensive relative to their ‘growth’ brethren.

Not since 2016 have value stocks outperformed growth stocks in the first half of the year. And this is only the fourth time in the last decade that value stocks have appreciated more from January to the end of June. When looking at how each category performed for the full year, 90% of the time the leader at halftime proved to be the winner by year end. In 2016, the value category returned 6.1% for the year versus 1.3% for growth stocks and 3.8% for the S&P 500.

Why does this seem important? In 2020, the S&P 500 ended the year up 18.3%. A huge win given the February – March COVID crash. Growth stocks returned a massive 38.3%! Value stocks, however, eked out a small gain, at 2.7%. Napatree Capital’s flagship Focused Value strategy finished 2020 nicely, up 17.2%. Our research suggests that investors started rotating into sectors that have more perceived value, like financials, consumer staples, and energy, in the fourth quarter of 2020. There are macroeconomic factors which contribute to this trend, notably inflation and higher interest rates. We believe that retail investors don’t yet realize that the rotation into value is underway, and it is likely to get more coverage by the financial media in the coming months.

One more data point to consider: the consumer staples sector, which contains companies like Procter & Gamble, Pepsi, Costco, and Wal-Mart, is trading at the largest discount to the S&P 500 since April 2000. Boring, yes, but often times, when markets get frothy, boring is good.

Answering Today’s Most Asked Question

How can stocks continue to go up after notching 32 all-time highs already in 2021? First, we are value-oriented investors and are still uncovering compelling, long-term opportunities, despite the market’s continued upward trajectory. We don’t fear the inflationary pressure and agree with Dr. Yellen; higher interest rates would be a welcome trend. Behaviorally, humans suffer from recency bias which means many investors are still tethered to the extreme volatility from early 2020. That dynamic (see our first quarter commentary, “A Nervous Bull”) also supports higher stock prices, at least in some sectors. And finally, bull markets average 52.8 months in length with an average cumulative return of 154% while bear markets average 11.3 months in length with an average cumulative loss of -32%. Assuming the bull market began at the March 23, 2020 low, it should continue until about the end of 2023, if not longer. Or, if we look at the return statistics, the S&P 500 is up 92% since that low, meaning we are not yet two-thirds of the way to the historic average return.

At Napatree Capital, we don’t look for beginnings and ends or tops and bottoms. Investing is an ongoing process which we approach with discipline and patience, confident in our ability to manage portfolios throughout many market cycles.

- Measured by the Russell 1000 Growth index and Russell 1000 Value index

- Past performance is not an indicator of future results. Model based performance, results vary by account due to cash flow and timing

- Bloomberg data, using the estimate of the 1 year forward P/E ratio