You’ve heard we’re in a bear market. We don’t particularly care for that term because it only helps stoke investors’ fears. Too much ink is wasted on deciding when a bottom occurs during “bear” markets. It is a fool’s errand.

The current investment climate is concerning. The weakness we’re seeing in stock and bond prices is almost without precedent. To put it in context, take this statistic from Sundial Research (www.sentimentrader.com) regarding the added pressure on stocks on Thursday, June 16:

More than 90% of stocks in the S&P 500 declined today.

It’s the 5th time [we have seen this level of selling] in the past 7 days. Since 1928, there have been exactly 0 precedents. This is the most overwhelming display of selling in history.

Timing the market is impossible. The best traders cannot do it consistently (there is plenty of data to support this). The best investors do not attempt it but instead look for opportunity, especially amid a stock market like we’re currently experiencing. Let’s discuss opportunity – using history as a guide and a bit of common sense – because intense selling has historically preceded a rally in stocks.

Investing Amid Market Turmoil: 2008-09

During the 2008-09 Great Financial Crisis, markets endured non-stop selling. For the sake of comparison, we will use this period to illustrate how a disciplined strategy of dollar cost averaging during challenging markets makes sense. We recognize that a) every bear market is different, b) we have no idea how much lower stocks can go, if lower at all from here and c) 2008-09 is probably not great comparison because we believe that was a once in a century type of financial rout, which we feel strongly is not the case today.

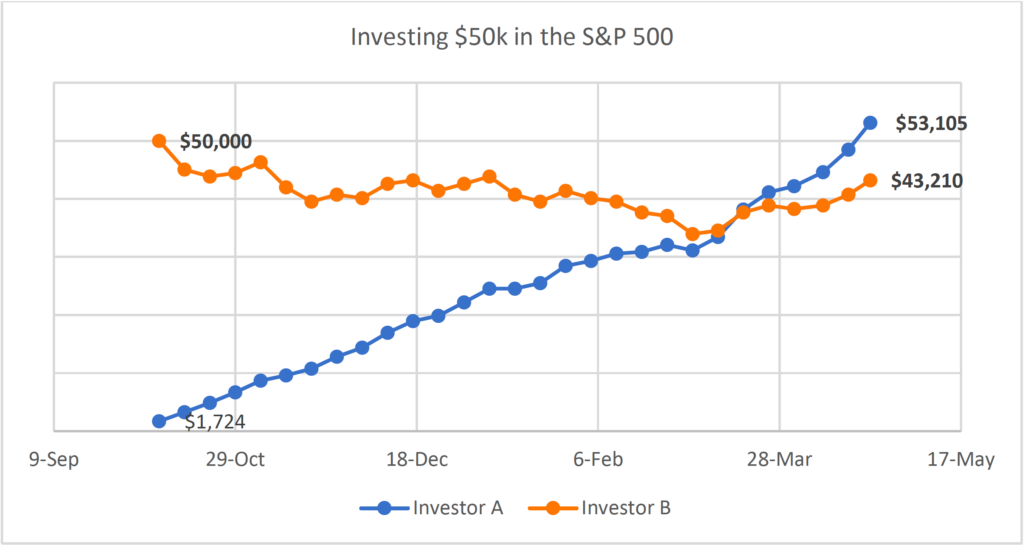

Back in 2008, from the first week of September to the first week of October, the S&P 500 contracted about 20%, roughly in line with what the S&P 500 has given up since the beginning of 2022 to today. From that point forward, stocks continued to sell off until bottoming on March 9, 2009. The chart below shows the results of a measured approach of investing $50,000 in equal increments – approximately $1724 per week – for 29 consecutive weeks versus investing a lump sum of $50,000 in October 2008, when the market had already lost more than 20% in value.

Investor A: allocates $1724 per week for 29 weeks

Investor B: allocates $50,000 in a lump sum

As shown in the above chart, incremental investing during one of the most intense bear markets in recent history, had profound results. Investor A generated nearly 25% more than Investor B (who was still not profitable). Further, dollar cost averaging may help relieve the pressure and anxieties that lead to costly mistakes (i.e. getting out and never getting back in) that accompanies “picking the bottom”.

To reiterate: we do not believe this is a 2008-09 type of market, but given the extreme moves in that period, it is a good proxy for investing on weakness, which should yield results over time. And the 29-week period, if started today, would carry an investor to year end, which is why we used that time frame. Most investors want to sell at the highs and buy at the lows, but the practicality of such an idea is absurd.

Do we think we’ve seen the bottom? We think it may be close but can’t say for certain. Is it scary to continue to hold stocks? Absolutely.

Headwinds persist in almost every investment category: stocks, bonds, precious metals, and crypto have all had negative returns year to date. The inflationary pressure and macro-economic issues have been well documented. The only certainty is uncertainty.

Now is the time to focus on the long term, move away from the fear generated by headlines, and adhere to a disciplined strategy, one that may actually excite you to buy when prices are falling.

Please contact us to discuss your personal situation if we haven’t spoken recently.

Napatree Capital LLC (“Napatree Capital”) is an SEC Registered Investment Advisor (“RIA”). Napatree Capital provides investment advisory and related services for clients nationally. Napatree Capital will maintain all applicable registration and licenses as required by the various states in which Napatree Capital conducts business, as applicable. Napatree Capital renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Past performance is not an indication of future results.