In our last quarterly commentary, “A Nervous Bull”, we discussed how a little bit of investor worry actually fuels a bull market. The volatility of the past week has not changed our opinion. In fact, we believe the type of pullback we are seeing in stocks is a welcome event and should propel the market higher, potentially much higher. As always, our outlook is based on analysis of a comprehensive and reliable data set, factoring in macroeconomic, fundamental, and technical factors. Here’s our take on the current investment themes.

Rotation into Value

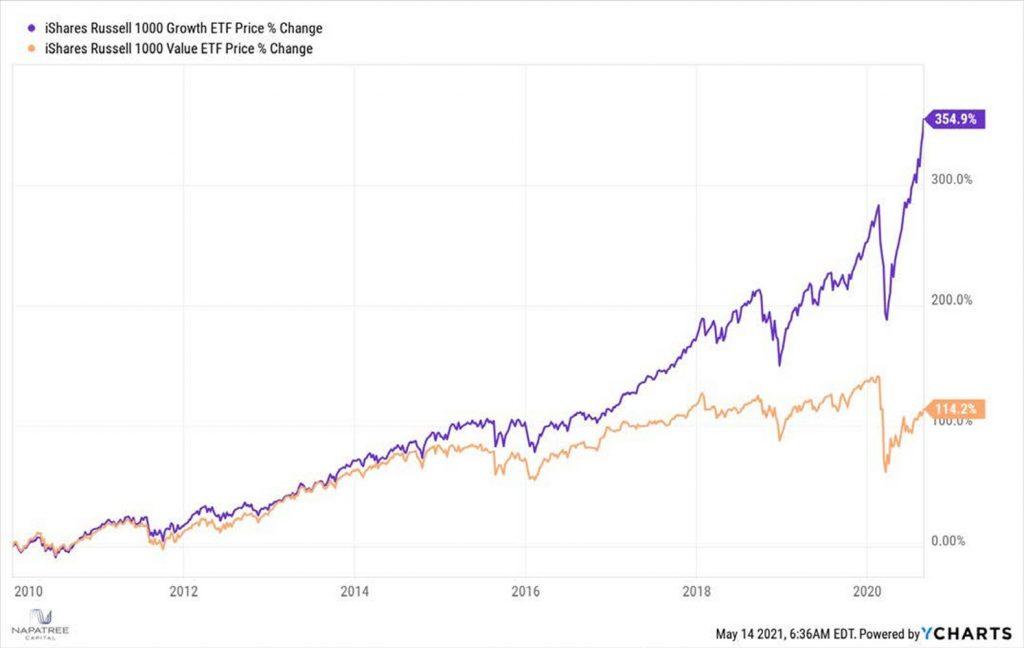

Growth stocks, i.e. Facebook (FB), Tesla (TSLA), Amazon (AMZN), Netflix (NFLX), have significantly outperformed value stocks, i.e. CVS Health (CVS), JP Morgan (JPM), Johnson & Johnson (JNJ), Walt Disney (DIS) for the past decade. As the overall market has become increasingly expensive, institutional investors have started to favor more value. That rotation began in the Fall of 2020. Best told in pictures below:

We acknowledge that the chart below is only eight months of returns, versus the chart on the on the top, illustrating a much longer time frame, roughly 117 months. But prior to this rotation, the performance gap between growth and value had never been greater. And there tends to be much more attention paid to the “sexy” growth stocks by the financial media. As value investors, this is a welcome trend.

Inflation Worries

The Consumer Price Index, or CPI, is widely seen as the best gauge of inflation. On May 12, the monthly report revealed a surge in prices of 0.8% vs expectations of 0.2%, lifting the 12-month rate of inflation to 4.3%, the highest reading since September 2008. After hitting an all-time high on May 7, stocks prices slid almost 6% in three trading sessions, with May 12 being the weakest. We don’t think inflation is a problem yet, and certainly not a surprise, based on the following factors:

- Inflation is the enemy of the bond market, typically causing bond yields to spike. Yields on bonds (i) went higher on that Wednesday report, but reversed yesterday. Interestingly, yields were up 25% from the start of the year.

- Commodity-based sectors have been conveying that inflation is here. A fund that tracks agricultural commodity prices (ticker: DBA), and one that tracks lumber (ticker: WOOD), and another that tracks metals and mining (ticker: XME) are up 14.8%, 17.8%, and 33% year to date, respectively, vs the S&P 500 up roughly 10%.

Sentiment – Always Something to Worry About

We are contrarians. As investors get more pessimistic, we become more bullish. Interestingly, the fear in the market – based on a compilation of solid data, illustrates a higher level of pessimism than 12 months ago. The S&P 500 is up nearly 60% since then (ii). Think of it like this: the stock market is in a solid uptrend. When stock prices sell off it is always uncomfortable, but not at all uncommon. The quicker that near-panic sets in, the better it is from a long-term perspective. It is the fuel that pushes stock prices higher, or at the very least, provides a bottom in prices.

Our experience has taught us to use volatility to our benefit. We did it last March (see our note on the Coronavirus Reaction, March 15, 2020, five trading days prior to the bottom) – you likely saw a sharp increase in trading activity in your accounts – and the results have been excellent (iii).. Buying on weakness is never comfortable, but our discipline and philosophy dictates that we need to be opportunistic when the market allows it.

Stocks are in a bull market. Bull markets die on euphoria and excessive speculation. Economic and fundamental data change but human behavior does not. And as far as we can tell, that behavior is clearly not euphoric.

i Using the 10-15 year synthetic treasury

ii Based on the CNN Fear & Greed index and data taken from Sentimentrader.com

iii Client portfolios are subject to individual needs and objectives and results vary