One of the more nuanced dynamics in the stock market this year is the wide range of performance among various indices. The technology-led Nasdaq has been the clear winner for the first six months of 2023, up 32%, far outpacing both the Dow Jones Industrial Average and the much broader S&P 500, which are up 4.8% and 16.8% respectively. Below are the returns of some of the more widely watched indices through June 30:

| Index | Second Quarter Return | Year to Date Return |

| S&P 500 | 8.7% | 16.9% |

| NASDAQ | 13.1% | 32.3% |

| Dow Jones Industrial Avg | 3.4% | 4.9% |

| Small Cap Index | 5.3% | 8.1% |

| Int’l Developed | 3.3% | 12.5% |

| Int’l Emerging | 0.9% | 5.2% |

| Gold | -0.5% | 5.7% |

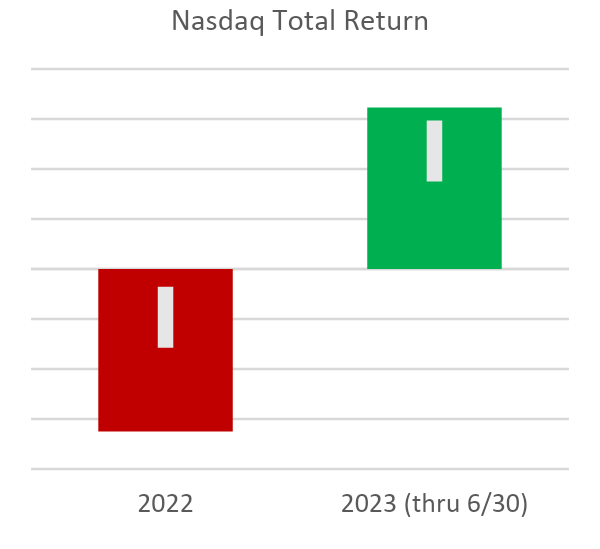

A common disclosure in the investment industry is “past performance is not an indicator of future results.” The sharp contrast in performance of stocks that make up the Nasdaq Composite illustrates that perfectly, as seen here. It is remarkable that the return for the first six months of 2023 is a mirror image of the performance in 2022 (albeit in the opposite direction). That does not mean, however, that if an investor bought $1000 of that index at the start of 2022, she was back to breakeven as of June 30. The math isn’t that simple.

A negative 32.5% return on $1000 would equal $675 at the end of 2022.

A positive return of 32.3% would equate to $893 as of the end of June, which means the investor still has a negative return of nearly 11% from January 1, 2022 to June 30, 2023.

What’s the point?

- Don’t chase performance

- Timing the market is guaranteed to end in failure

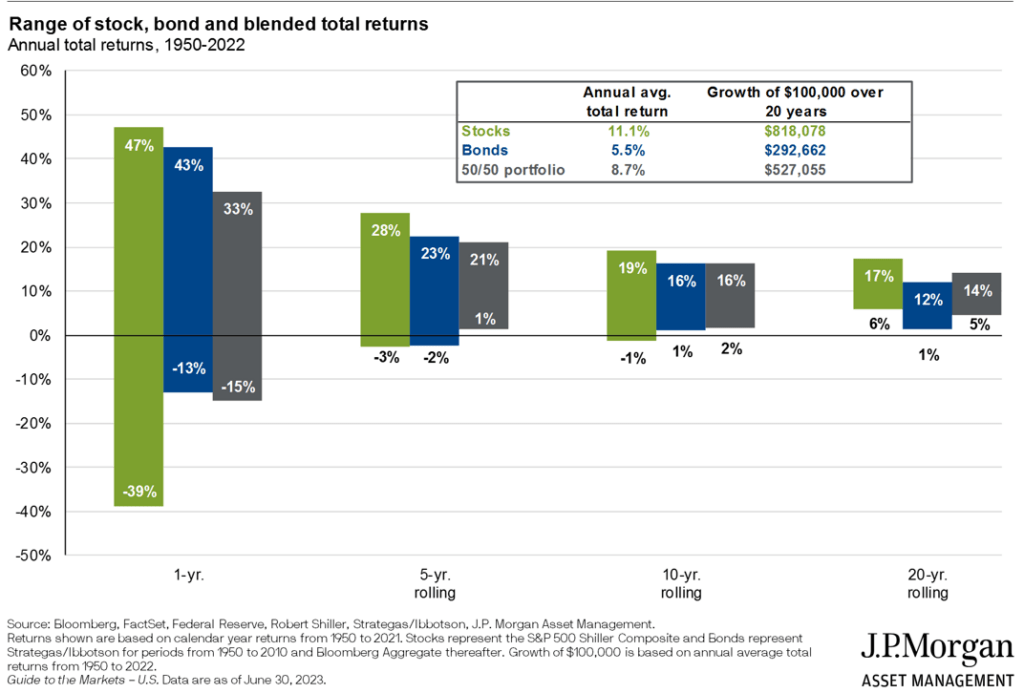

- Investors must have a long-term view and patience

- Expect volatility, which should lessen the longer you are invested

It is best summed up in the chart below, prepared by JP Morgan, which clearly displays that the longer one’s time frame, the less severe the losses.

Interesting Data Points

There is no lack of data when looking at financial markets and investing. To that end, here are some interesting facts and figures as the year progresses past the halfway point. Some have investment utility, and some are merely curious observations.

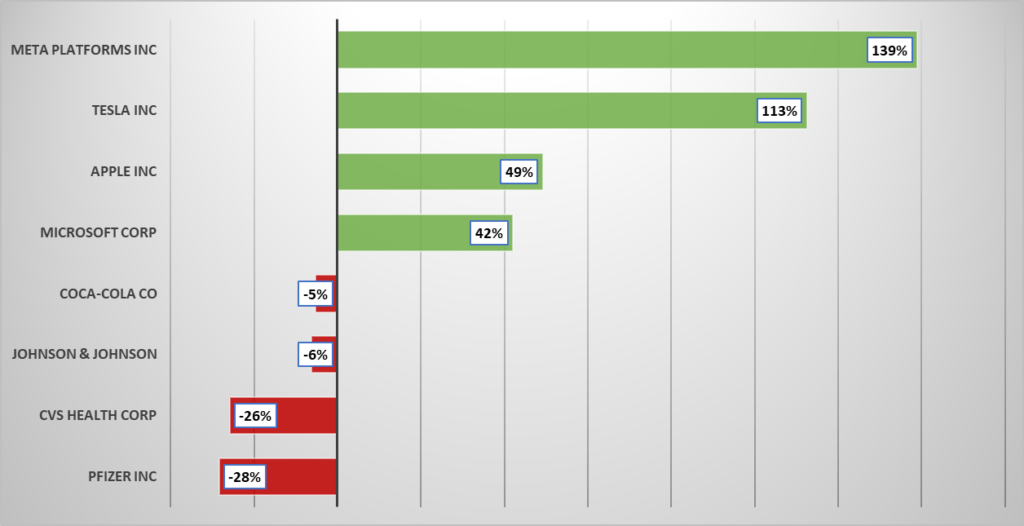

- Classic “Blue Chips” – outside of the tech sector – have woefully underperformed mega- and large- cap technology shares (which drove the Nasdaq’s performance).

- A sample of well-known, large companies and their returns from January to June

- The combined market value of Apple and Microsoft is about $5.5 trillion. The combined market value of the ten largest non-technology related companies – Berkshire Hathaway, Visa, United Healthcare, JP Morgan, Exxon, Eli Lilly, Walmart, Johnson & Johnson, Mastercard, Procter & Gamble– is about $4.5 trillion. Apple and Microsoft employ 385,000 people; those other ten have more than four million employees.

- Per JP Morgan, shares of value stocks are trading close to their long-term average valuation, whereas shares of growth stocks are approximately 30% overvalued vs their long-term average valuation.

- At the current pace, the Nasdaq Composite Index will have beaten the Small Cap Index by the widest margin in almost 25 years; the Nasdaq is up 32% vs 8% for Small Caps

- The two years with the largest outsized gains- other than this year – immediately followed periods of extreme volatility, 2009 and 2020, when the Nasdaq outperformed Small Caps by 24% and 15% respectively.

- The number of available homes for sale in the US hit a four decade low in February of 2022. Even though inventory has nearly doubled since then, there are still 60% fewer homes for sale than in July 2016.

- From 2009-2020, home buyers spent between 15% and 21% of their total household income on housing. Today the share of household income spent on housing is nearly 35% due to the appreciation in real estate prices and higher mortgage rates.

- It has been over 40 years since housing was this unaffordable: From 1980-1984, 40% to 50% of household income was spent on housing.

- Is inflation peaking? In June 2022, the cost of energy (oil, gas, etc.) was up 40% and the price of food up nearly 10% from the previous year. As of this June, the price of energy is down 13% while the price of food continues to increase, up 4.5% from last year. It takes fuel to move goods around the country, so lower energy prices should bring relief to our grocery bill soon.

- Shares of non-US stocks may be poised to outperform. Based on current price to earnings, stock markets in Europe and Japan are each trading 17% below their 25-year average valuation, and Chinese stocks are trading 15% below their 25-year average valuation. Shares of US companies (S&P 500) are 14% overvalued based on the same metric.

While markets have exhibited strength this year, it has been a narrow advance led by fewer than ten mega cap stocks that have had massive returns. Broad participation by a wide range of stocks of varying sizes and differing sectors typically bodes well for further gains, but this has not been the case. The market is at a crossroads. Either those underperformers outlined above (CVS, Johnson & Johnson et al.) “catch up” and participation expands, or the sharp gains made by the few tech companies reverse without broader contribution from other sectors, which would lead to weakness. Our outlook remains constructive for stocks. Why?

In the past twelve months, interest rates have risen faster than any time in history. Add to that three of the largest bank failures ever, a debt ceiling crisis that nearly pushed the US to default, several surprise cuts in oil production by OPEC to maintain higher prices, continued conflict in Ukraine, and 30-year mortgage rates hovering around 7%, the highest level since 2002. Meanwhile the S&P 500 has increased by double digits through the end of June.

Warren Buffett said “the stock market is a device to transfer money from the impatient to the patient.” The economic and geopolitical events of the past year heightened investors’ anxiety. Don’t allow those emotions to overtake a patient approach to investing. At Napatree Capital we never do.

1 Total return, which assumes dividend reinvestment.