The start of the fourth quarter has been rough for financial markets, a follow-through from when stocks hit a 12-month high in July. The factors contributing to the sell-off:

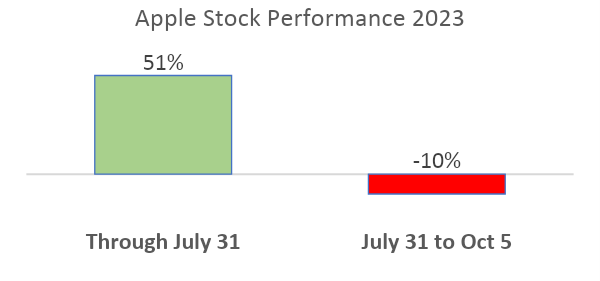

- As stated in our last commentary, the run up in the S&P 500 in 2023 was led by seven stocks with outsized returns: a narrow advance. Healthy bull markets are accompanied by broad participation across many stocks and sectors, the lack of which has been a concern throughout 2023. Since July, those leading stocks have sold off. For example, the performance of shares in Apple, the largest and most widely held stock in the S&P 500:

- The bond market has been anything from a “safety zone” for investors. It isn’t necessarily the rise in rates that has been damaging, but the speed at which rates have increased. A rise in rates causes valuations of all asset classes to adjust.

- The economic environment is also sending mixed signals to investors. Because the Fed has been so aggressive at raising short term rates to fight inflation, there is heightened sensitivity to inflationary indicators, such as employment or energy prices. Economic data has been persistently good. Markets want to see some weakness in the economy, a sign that the aggressive measures by the Fed are working to stem inflation, but not too much.

- “Sell in May and go away” is a common Wall Street saying which illustrates the weakest seasonal period for stocks based on historic data. It seems to have played out this year.

All is not dire, however. Financial markets look ahead and so do we . . . below is our stance on the issues outlined above:

- Stocks that have done poorly this year are exhibiting signs of being extremely oversold, with compelling valuations. For example, shares of Target (TGT) are trading 25%-30% below its historic average valuation, and more than 50% below its peak valuation. The stock is down 27% year to date, after losing 34% of its value in 2022. If such stocks start to rally, it should be healthy for the broader market.

- The Fed runs the risk of moving too far too fast with rate hikes. Bond market stability is the key to stock market stability. In the past two weeks there has been more commentary by Fed officials which suggest slowing, or even halting rate hikes, which should calm the bond markets.

- Energy prices – and energy stocks – have come down dramatically in the past five sessions. Energy prices tend to be a leading inflationary indicator.

- The fourth quarter is historically the best quarter for stock performance, and, on average, returns are nearly twice as good as any other quarter.