We are constantly asked, “is now a good time to invest in stocks?”

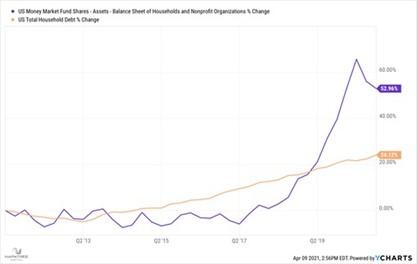

One of the data points our investment committee monitors is cash balances, as measured by money market balances. Currently there is $2.4 trillion in cash, a figure which needs some context, so let’s look at cash to total household debt:

Since late 2019, investors have been sitting on increasingly greater cash balances, especially as a percent of overall debt. This is a positive trend for both households and investors.

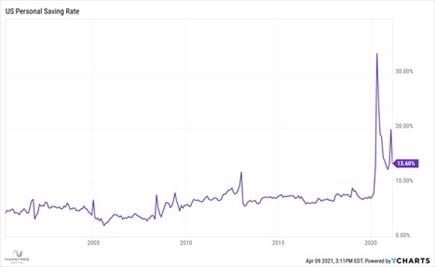

Understanding savings by Americans provides a window into behavior toward investing. The US Personal Savings rate hit an all-time high of nearly 34% in March 2020, which translates to 34c of every dollar going under the mattress. Which also means spending is curbed considerably. This makes sense as we halted spending on anything but bare essentials as we entered lockdown.

As we near the end of the pandemic, we are still saving almost 14c of every dollar, which is higher than the depths of the Great Financial Crisis. And we are well aware of how stocks have performed since 2009.