The news of the week in the financial world was without a doubt, the debut of the Coinbase Initial Public Offering under the ticker symbol COIN. Coinbase is an exchange for Cryptocurrencies like Bitcoin, Ethereum and other ‘Alt Coins’. The service enables a user to go on their website or download their app, easily connect to your bank account and purchase a variety of cryptocurrencies. Coinbase, in addition to other similar platforms, are demystifying the purchase of crypto by making it easy and accessible to the general public.

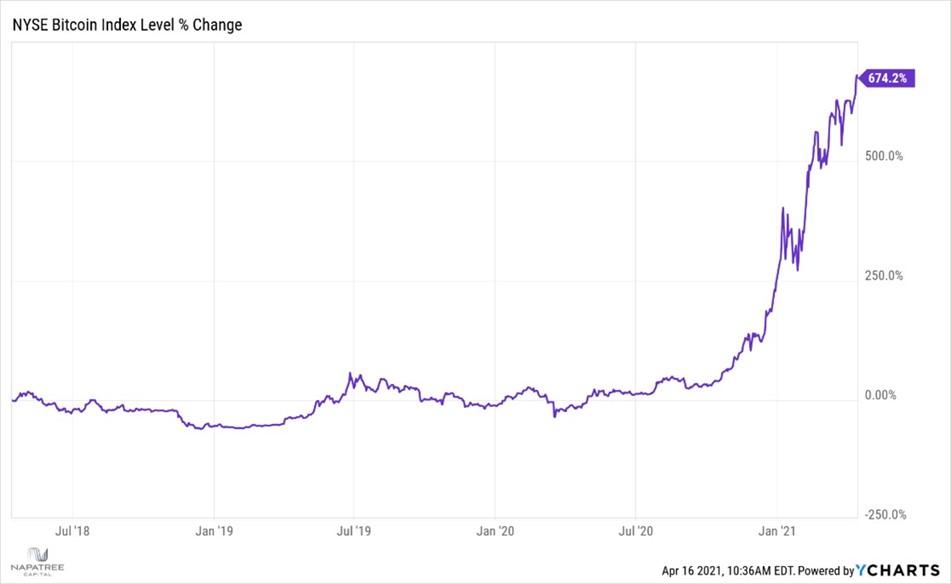

The much-anticipated offering was a landmark event in the “crypto” community. First and foremost, it is the culmination of what is very much a Cinderella story. A short time ago, Cryptocurrencies were snubbed either as a joke – ‘fake money’ if you will; or it was seen as the stuff of criminals – enabling people to transfer money anonymously. As the world of technology has evolved, the ability to keep a store of value in secure code has become more attractive and more widely understood. The technology being built around the various types of cryptocurrencies is also maturing and becoming more convincing. And the currency has soared.

Traditional Wall Street institutions are beginning to notice. An increasing number of asset management firms have been registering with the SEC to create ETF’s or Exchange Traded Funds, that invest in crypto. In the past 18 months, public companies have converted cash on their balance sheets to Bitcoin – from Tesla to MicroStrategy, the latter a company that has made huge bets on Bitcoin by investing somewhere around $4.4 Billion in the digital currency. And the digital currency is now accepted as a standard form of payment everywhere from Pizza Hut to AT&T to Virgin Airlines. There are even some realtors allowing payment for

homes in Bitcoin.

So, what of the IPO? Jumping in price to a high of $429.54 on opening day, the share price as of the time of this writing (two days after the listing) is $327, valuing the company at $65 billion.

Coinbase turned profitable last year – which is hardly the case for many companies that have gone public recently. In 2020, Coinbase’s revenue went from $483 million to $1.14 billion and operating profits rose from -$45 million to $409 million. Its user base has grown exponentially from 2.8M users at the end of 2020 to 6.1M in Q1 of 2021.

Don’t believe the hype?

The critical question is do you believe that Cryptocurrencies are the future of money? Believers tout Crypto’s ability to fight inflation, secure storage from hackers and cyberthieves, and the enablement of new technologies looking to leverage digital currencies to securely run everything from stock trading platforms, banking and more. Its detractors still see it as a harbor for the lowest criminals, or falsely inflated fake money, a rapidly rising bubble that will pop at any moment and even go to zero.

And in the midst of the argument lies Coinbase, raking in profits and notoriety as the first built-for-crypto company to be listed on the NYSE.

Will it last? Only time will tell.