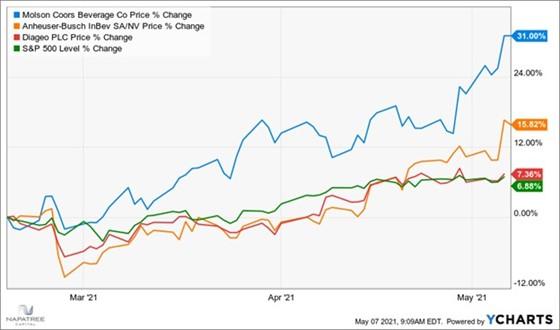

We have talked with many of you about Napatree Capital’s flagship Focused Value strategy. Focused Value currently owns 47 high quality companies that in our analysis, have been temporarily underestimated and mispriced by the market. The following is a brief analysis behind a recent addition to the Focused Value portfolio: Molson Coors (symbol: TAP). Our investment team continually […]

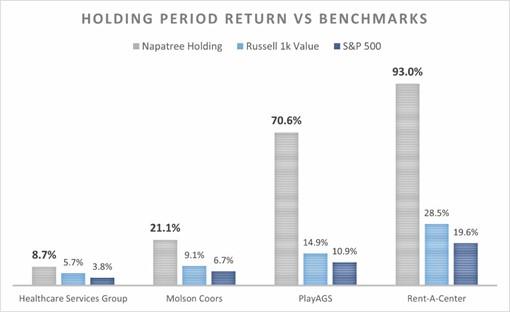

Read MoreIn this week’s brief, we thought it might be interesting to share our most recent investments in our flagship Focused Value equity strategy. These four investments, shown below in descending chronological order, are Healthcare Services Group (HCSG), Molson Coors (TAP), PlayAGS (AGS), and Rent-A-Center (RCII). As illustrated below, the longer our holding period, the greater the […]

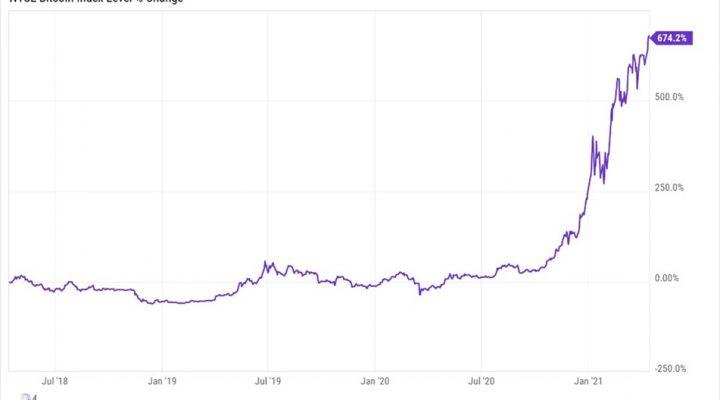

Read MoreThe news of the week in the financial world was without a doubt, the debut of the Coinbase Initial Public Offering under the ticker symbol COIN. Coinbase is an exchange for Cryptocurrencies like Bitcoin, Ethereum and other ‘Alt Coins’. The service enables a user to go on their website or download their app, easily connect […]

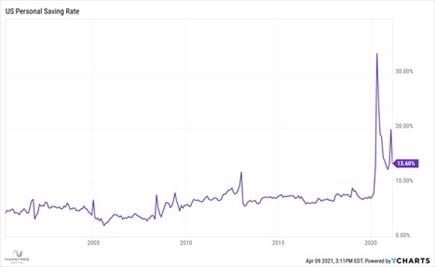

Read MoreWe are constantly asked, “is now a good time to invest in stocks?” One of the data points our investment committee monitors is cash balances, as measured by money market balances. Currently there is $2.4 trillion in cash, a figure which needs some context, so let’s look at cash to total household debt: Since late […]

Read MoreFrom January 1, 2010 to December 31, 2019, being out of the market dramatically impacted total return on your investments. We have no idea when the best days will occur, but missing the 20 best days in this ten year period cost an investor a whopping 50%. Yes, but what about the COVID crash of […]

Read MoreA year ago this week, the stock market formed a significant bottom. Stock prices dropped nearly 35% in less than five weeks due to the economic impact and fears of the coronavirus. We would consider it a crash. Crashes often occur from an unpredictable, exogenous event, that is fueled by extreme economic uncertainty, and culminates […]

Read More- « Previous

- 1

- 2

- 3